How Dollars Are Made: The Journey of American Currency

Money has always exerted a fascinating power over humanity. We will explore how dollars are made. This is a dynamic story of the American dollar, an enduring symbol of security, trade, and national pride. From its historical beginnings to the complex processes that create it, the story of American money is a tale of art, creativity, and change. The origins of the American dollar can be traced back to the late 18th century, when the Coinage Act of 1792 established the U.S. Mint and laid the foundation for a standardized national currency system.

The History of American Currency

Early Beginnings: Colonial Money

The inception of American currency was born out of necessity. During colonial times, the different types of money showed the special economic conditions of each colony. From New York’s wampum to Virginia’s tobacco notes, different systems flourished. Additionally, colonists often traded using goods, foreign coins, and various forms of paper money. Consequently, to add complexity, each colony exercised autonomy, leading to a tangled financial ecosystem.

Colonial scrip, an early form of paper money, was innovative but unstable. Massachusetts printed the first paper money in 1690 to pay for military trips, marking a big change from traditional bartering. Obviously, these notes varied in value and credibility, leading to skepticism and instability.

Over time, Colonial money’s inconsistencies pushed for a more unified approach. As grievances against British rule mounted, so too did the desire for an independent economy. Eventually, this led to the birth of a currency that would unite the American colonies under a cohesive and singular economic banner.

The Birth of the U.S. Dollar

The birth of the U.S. dollar in 1792, following the Coinage Act, marked a transformative phase in American financial history. Surprisingly, the dollar was pegged to the Spanish dollar, a highly trusted unit at that time. Basically, this move aimed to establish financial stability and encourage trust in a new national system.

The dollar featured the classic images of freedom and independence, two ideals central to the country’s identity. The iconic design signified an era of fresh ideals and ambitions. With the dollar now in circulation, a unified economic system began to take shape, bolstered by confidence at both domestic and international levels.

The dollar’s rise also led to the creation of the United States Mint, which faced the complex task of making physical money that could inspire national pride.

Major Milestones in Currency Development

As the U.S. expanded and matured, its currency evolved, keeping pace with economic, political, and social challenges. Key milestones dotted its trajectory. The Gold Standard was replaced by more flexible money systems, showing a currency that can change due to outside influences and internal policy choices.

During the Civil War, fiat currency emerged as paper notes known as “greenbacks” gained prominence. Though at first controversial, these notes helped stabilize the war-torn economy by acting as trustworthy legal tender. The change not only strengthened the Union financially but also showed how currency can adapt in uncertain times.

The establishment of the Federal Reserve System in 1913 marked another significant milestone. It helped control banks and manage the amount of money, protecting the country’s economy in the end.

Designing the Dollar: Art Meets Functionality

The Artistic Process Behind the Bill

One of the most captivating aspects of American currency lies in its design. The artistry at play on every dollar bill is a result of meticulous effort and creative vision. Additionally, the design process combines looks with use, finding a balance between creativity and usefulness.

A team of talented engravers and artists laboriously creates the designs of each bill. Their work involves striking plateless images that must meet both artistic and security considerations. So, it requires a delicate balance of creativity and precision. Every part, from pictures to detailed backgrounds, is carefully made to ensure they are clear and sophisticated.

Also, important people from history and famous national symbols are shown on these bills, reflecting the country’s rich history. The purpose is not just to create a means of exchange, but a canvas that tells the ongoing American story, transcending mere transaction.

Security Features to Combat Counterfeiting

Security is crucial for keeping the reliability and trust of any currency. Specifically, the U.S. dollar includes a complex set of security features, aimed to stop counterfeiting and make sure it’s real. Particularly, these features include watermarks, color-shifting ink, and security threads that are embedded within the paper.

New technologies, like tiny printing, color-changing ink, and 3D security strips, are important parts of this protection. Undeniably, each feature is an obstacle in the potential counterfeiter’s path, with efforts made to update and improve these safeguards continually.

Perhaps the most iconic security feature is the copper-to-green color shift in the ink used on the numerals. While visually striking, it also shows the deep layers of security carefully built into the bill’s fibers. Embedded security threads and watermarks give extra protection, drawing attention and admiration for their gentle shine.

The Printing Process of U.S. Dollars

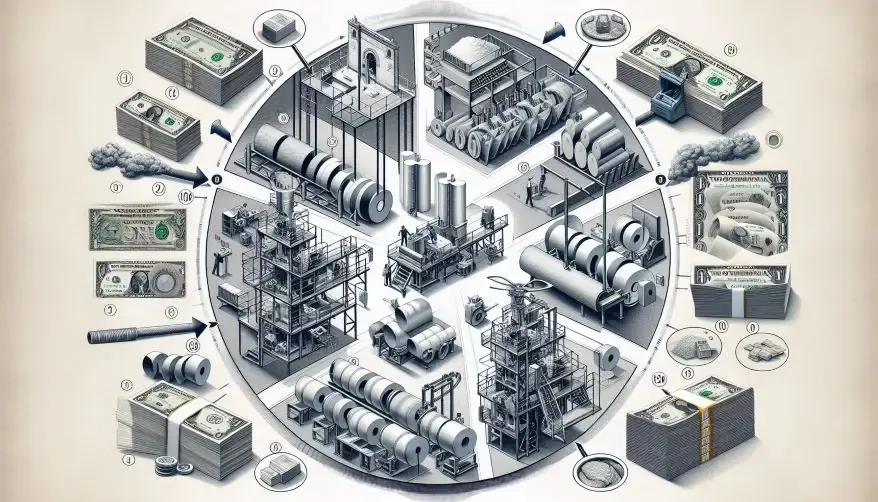

From Paper to Bill: The Life Cycle

Making a dollar bill is a careful task that starts with choosing strong, high-quality materials. Actually, the life cycle of a dollar involves multiple stages, each critical to forging a bill that withstands five to fifteen years of exchanges. Likewise, the process starts with the production of a unique blend of cotton and linen paper, which gives the U.S. currency its distinctive feel and durability. This special paper is produced by a single supplier, ensuring consistency and security in the materials used.

Specialized cotton-linen paper forms the backbone of the dollar, a durable yet pliable substrate that withstands consistent handling. This material goes through strict testing to make sure it can withstand different environments throughout its life.

After that, the printing process starts. It is divided into several steps, including intaglio, offset, and numbering printing. Each stage adds layers of intricate artistry, culminating in a vibrant, secure product. Furthermore, making sure designs line up correctly across colors and techniques is crucial, as even slight misalignment can affect the quality of a bill.

Where and How U.S. Bills Are Printed

The United States Bureau of Engraving and Printing possesses the monumental task of producing the country’s currency. With facilities in Washington, D.C., and Fort Worth, Texas, the Bureau uses modern machines along with skilled workers, blending advanced technology with traditional methods. Moreover, the Bureau’s facilities are equipped to handle the complex processes required for currency production, ensuring each bill meets stringent quality standards.

The intaglio printing technique is a hallmark of the process; it uses engraved plates to press the design into the paper, creating raised textures that differentiate genuine currency from counterfeits. Moreover, facilities use strict quality checks, examining each note to make sure it meets high standards of excellence.

Actually, greenbacks are made using safe inks developed after a lot of research. These inks resist fading but keep their bright colors, showing the new ideas behind how strong the currency is.

Distribution: Getting Dollars Into Circulation

The Role of Federal Reserve Banks

Once printed, the journey of money continues through the complex machinery of the Federal Reserve System—a group of 12 Federal Reserve Banks managing the national money supply.

These banks act as pivotal distributors of new currency, supplying banks nationwide with freshly minted cash. Their mandate extends beyond merely issuing funds; they also serve as vital conduits for returning worn or outmoded cash, thus maintaining overall currency quality.

Moreover, the banks ensure a fair distribution of resources, using insights from detailed data analysis to match supply with demand. This carefully planned effort ensures a stable money system, showing wider economic trends.

How Currency Reaches You

The path of a dollar from printing press to individual wallet involves a chain of complex logistical operations. Banks, stores, and transport services work together, creating an unseen path that connects people with their money needs.

Money travels long distances, protected by strong security measures. Once delivered, it spreads into everyday transactions, easily becoming part of the flow of economic activity.

Banks play an important role by helping with everyday cash transactions. From bank tellers to ATMs, their infrastructure is designed to cater to both consumer and commercial demand, keeping dollars perpetually in motion.

Challenges and Innovations in U.S. Currency

Adapting to a Digital Economy

In a time ruled by technology, U.S. money encounters special challenges. So, the shift from mobile payments to digital wallets changes traditional shopping a lot.

Eventually, Government organizations and private partners study how currency is used in a more digital economy. They are looking into digital currencies and making old-style payment methods simpler to keep money important today.

In fact, this digital change requires careful examination of current systems as they adapt to growing trends. So, making sure currency is safe and easy to use is very important. This brings up key questions about how money changes with the times.

Future Trends in Currency Design

As technology continues to improve, new trends in money design are significant for understanding changing surroundings. Particularly, new ideas include using eco-friendly materials, environmentally safe designs, and better security features.

Using new technology like augmented reality and interactive apps might change how we use money, making it more enjoyable while keeping it useful.

So, beyond printed notes, the artistic expression in currency design may extend to digital uses. As the world adopts blockchain and digital currencies, changing looks could change how people see and interact with the core idea of money itself.

In conclusion, the tale of American currency mirrors the nation’s ongoing quest for innovation, enriched by a profound connection to its storied past. Art mixes with skill to create a currency that is not only functional but also a symbol of national identity.

References

- Chahrour, R., and Valchev, R. (2021). Trade finance and the durability of the dollar. The Review of Economic Studies, 89(4), 1873-1910. https://doi.org/10.1093/restud/rdab072

- Gallarotti, G. M. (2023). The classical gold standard as an international monetary regime. The Anatomy of an International Monetary Regime, 16-57. https://doi.org/10.1093/oso/9780195089905.003.0002

- Gelinas, U. J. (., and Gogan, J. L. (2008). Accountants and emerging technologies: A case study at the United States department of the treasury bureau of engraving and printing. Journal of Information Systems, 20(2), 93-116. https://doi.org/10.2308/jis.2006.20.2.93

- Goldberg, D. (2009). The Massachusetts paper money of 1690. The Journal of Economic History, 69(4), 1092-1106. https://doi.org/10.1017/s0022050709001399

- Paradise, P. (2024). Trademark counterfeiting, product piracy, and the billion dollar threat to the U.S. Economy. www.quorumbooks.com. https://doi.org/10.5040/9798216188292

- Yuan, J., et al. (2019). Dynamic anti-counterfeiting security features using multicolor dianthryl sulfoxides. Chemical Science, 10(43), 10113-10121. https://doi.org/10.1039/c9sc03948a

Additionally, to stay updated with the latest developments in STEM research, visit ENTECH Online. Basically, this is our digital magazine for science, technology, engineering, and mathematics. Furthermore, at ENTECH Online, you’ll find a wealth of information.